Last week, a college student in Texas sold his 2020 sedan to afford a single computer component. This isn’t fiction – it’s the reality for hardware enthusiasts facing unprecedented market conditions. What was once a $1,500 flagship product now commands prices exceeding $3,000 on resale platforms, creating barriers for both casual users and dedicated builders.

Industry leaders confirm this crisis extends beyond typical holiday demand spikes. During recent earnings discussions, executives warned about inventory challenges persisting through early 2023. Production adjustments for next-generation components have intensified competition for existing stock, particularly affecting high-performance models favored by creative professionals and simulation users.

The timing couldn’t be worse. Seasonal shopping patterns collide with constrained manufacturing outputs, creating a perfect storm. Consumers report waiting months for backordered items while secondary markets exploit scarcity through speculative pricing. This imbalance raises critical questions about long-term accessibility in enthusiast computing markets.

Key Takeaways

- Supply chain limitations continue disrupting hardware availability

- Holiday demand amplifies existing inventory shortages

- Premium components now cost 2-3x original retail prices

- Corporate production shifts affect consumer pricing structures

- Secondary markets capitalize on artificial scarcity

- Purchase timelines require strategic budget planning

Overview of Nvidia’s GPU Landscape and Recent Earnings

A university lab recently delayed critical research due to hardware acquisition challenges. This scenario highlights shifting priorities in computing resource allocation, particularly affecting institutions reliant on advanced processing solutions.

Enterprise Solutions Drive Record Profits

The third quarter showcased unprecedented financial results for a leading tech firm. Revenue reached $35 billion – a 94% annual increase – with net income doubling to $19.3 billion. Enterprise-focused products generated 87.7% of total earnings, demonstrating where production priorities lie.

| Market Segment | Revenue Share | Annual Growth |

|---|---|---|

| Enterprise Systems | 87.7% | +203% |

| Consumer Graphics | 9.1% | +15% |

| Other Solutions | 3.2% | +8% |

Manufacturing Challenges and Allocation Priorities

Supply chain limitations continue reshaping market dynamics. While enterprise demand grows exponentially, consumer-grade components face extended lead times. Production capacity for high-margin data center solutions now consumes 78% of manufacturing resources.

This strategic focus creates ripple effects across markets. Secondary sellers report 3-4 month waits for specific models, while enterprise clients receive priority access. The company’s future outlook suggests intensified development of next-generation data center architectures.

Financial analysts note the firm maintains 16% market share against larger competitors. However, its specialized solutions command premium pricing – particularly in machine learning applications where performance thresholds determine purchase decisions.

nvidia gpu shortage gaming impact: Supply Constraints and Pricing Dynamics

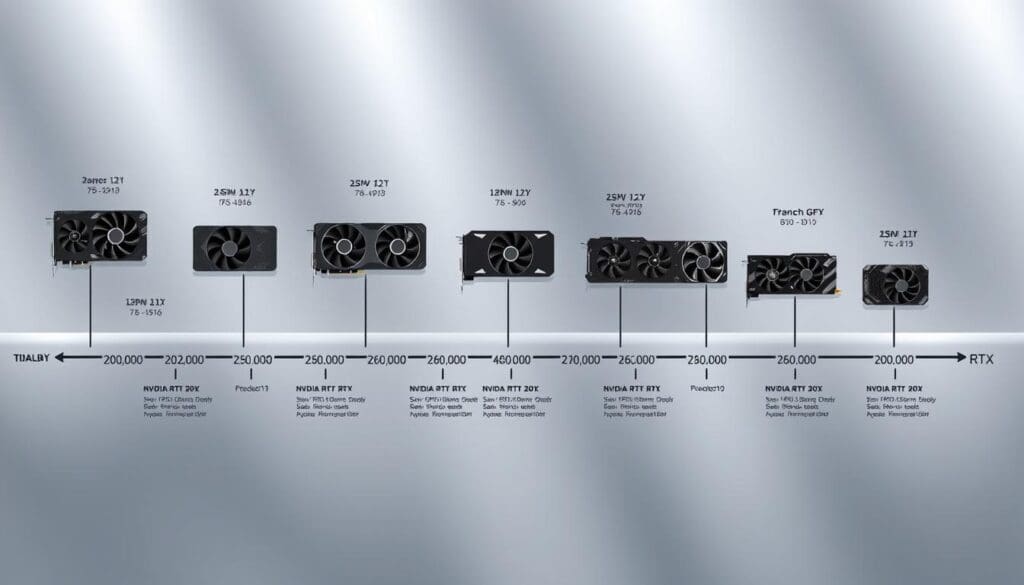

Manufacturers recently halted 98% of current-generation component production – a strategic move creating immediate ripple effects. This transition phase between product generations reveals critical insights into how supply chain decisions shape market accessibility. The abrupt discontinuation of flagship models has left enthusiasts scrambling for remaining stock.

Upcoming RTX 50-Series Transition

Production lines now prioritize next-generation architectures, leaving retailers with dwindling inventories. The RTX 4090’s early phase-out exemplifies this shift – its scarcity drove secondary market values to 218% of MSRP within weeks. One industry analyst notes: “When high-demand models vanish overnight, price speculation becomes inevitable.”

Corporate communications confirm these changes align with CES 2025 launch preparations. However, the timing intensifies challenges for consumers seeking upgrades during peak demand periods. System builders report 12-week delays for specific configurations, particularly those requiring premium performance components.

Holiday Season Market Pressures

Fourth-quarter demand traditionally accounts for 34% of annual consumer electronics sales. This year, limited availability collides with heightened upgrade cycles, creating unprecedented pricing volatility. Retail tracking data shows mid-range cards now sell at premium-tier prices – a 47% increase compared to Q3 averages.

While manufacturers promise improved supply allocations in early 2025, immediate solutions remain elusive. Consumers face difficult choices: pay inflated prices today or delay purchases until next-generation models arrive. This dilemma particularly affects users requiring cutting-edge capabilities for advanced applications beyond leisure activities.

Broader Industry Implications and Consumer Trends

Global chip allocation strategies now face pressure from geopolitical tensions and shifting consumer priorities. Recent data shows desktop graphics shipments fell 3% in late 2024, while mobile solutions grew 2% – a trend reflecting changing workstation preferences.

Global Market Dynamics and Tariff Influences

Trade policies add 18-22% to component costs in key markets. Dr. Jon Peddie notes: “Tariffs disrupt supply chains more than production delays. Companies must choose between absorbing costs or passing them to consumers.” This creates regional price disparities – European buyers pay 14% more than North American counterparts for identical cards.

Competitive Landscape: AMD, Intel, and Shifting Demand

Intel controls 63% of integrated graphics shipments, but discrete solutions drive innovation. AMD’s RX 9070 series aims to capture 25% of the premium segment by Q2 2025. Their strategy focuses on:

- Enhanced AI rendering capabilities

- Backward compatibility with older systems

- Aggressive pricing at 80% of competing flagships

Industry Analyst Insights and Forecasts for 2025

Discrete solutions may reach 15% market penetration by 2029, but growth faces hurdles. One report warns: “Component shortages could reduce annual sales growth by 4.7% through 2026.” Mobile workstations emerge as wildcards – their 8% quarterly sales increase suggests permanent shifts in professional workflows.

Conclusion

Recent market analyses reveal a critical juncture for high-performance computing hardware. The current scarcity stems from strategic manufacturing shifts favoring enterprise clients over individual buyers. Production timelines now prioritize data center components, creating supply gaps for consumer-focused models like the RTX series.

We anticipate gradual improvements by early 2025, though market dynamics will continue favoring commercial applications. This situation demands careful planning from buyers – timing purchases around product cycles becomes essential. Those needing immediate upgrades face tough choices between inflated prices and delayed acquisitions.

The industry’s trajectory suggests lasting changes in allocation strategies. As companies optimize for profitability, consumers must stay informed about advanced computing solutions and market trends. While challenges persist, understanding these patterns empowers smarter purchasing decisions during transitional periods.

Ultimately, the graphics card landscape reflects broader semiconductor industry priorities. Buyers should prepare for ongoing volatility while monitoring production updates and emerging alternatives in competitive markets.

FAQ

Why are consumer graphics cards experiencing significant price increases?

Supply chain limitations and heightened demand from data centers have reduced availability for gaming-focused GPUs. Production prioritization for enterprise clients and tariff adjustments further amplify retail costs.

How does data center demand affect gaming GPU availability?

NVIDIA allocates a substantial portion of its chip production to AI and cloud infrastructure clients, which generates higher margins. This creates competition for TSMC’s manufacturing capacity, delaying consumer-grade product rollouts.

What role do tariffs play in current pricing trends?

Recent U.S. tariffs on Chinese-manufactured components increased production costs by 15–25%. These expenses are often passed to consumers, particularly affecting high-end models like the RTX 4090.

Are AMD and Intel benefiting from NVIDIA’s supply challenges?

While AMD’s Radeon series has gained modest market share in mid-range segments, neither competitor currently matches NVIDIA’s performance in premium tiers. However, pricing strategies from all manufacturers remain influenced by broader semiconductor shortages.

When will the GPU market stabilize?

Analysts project improved supply by late 2025 as TSMC expands 3nm production. However, holiday season demand and AI sector growth could prolong shortages for flagship models like the upcoming RTX 50-series.